The idea of “school choice” has a certain lure to it. Who doesn’t want more choice in where and how our kids become educated? Utah’s public school performance is in a free fall, and the writing is on the wall: public education has been co-opted by third-parties and outside interests and our children have become a means to somebody else’s ends, not an end in and of themselves.

But as has been mentioned before, Utah already has real school choice. Parents can choose to send their kids to:

A) Government-controlled and regulated schools (public or charter), or to

B) Non-government-controlled and regulated schools (private or home-based).

Choice B involves a trade-off — government doesn’t pay for these options, but parents have the freedom to choose exactly how and what they want their children to learn. Private and home school options offer parents true autonomy from government intervention, regulation, and interference because they don’t in any way, shape, or form fall under the general control and supervision of the Utah State Board of Education (USBE), which has broad constitutional powers to shape and influence K-12 public and charter schools in Utah.

But now HB331, the HOPE Scholarship Program bill, threatens to erase those boundaries for the approximately 150 private schools in Utah. How? By making public money available in the form of tuition and other educational expenses up for grabs by these private schools. And all they have to do is give private information and control of various aspects of their operations over to the USBE and to the Scholarship Granting Organization (SGO) hand-picked by the USBE.

What could possibly go wrong? Well, that depends on how much you trust the USBE to not politicize the governance and regulation of these schools. Given its track record over the past few years, parents shouldn’t hold their breath — the USBE’s reputation for weaving woke policies into everything it touches is aggressive and unabated.

Let’s examine a few of the specifics of this Faustian bargain that one group is claiming runs virtually “no chance of government taking control of the content of education.” The devil’s in the details, as the saying goes….

189 the student’s parent that the qualifying service provider selected by the parent for the student to

190 enroll in or engage is capable of providing education services appropriate for the student.

191 (b) A scholarship account application form shall contain the following statement:

192 “I acknowledge that: A private education service provider may not provide the same

193 level of disability services that are provided in a public school;

194 (1) I will assume full financial responsibility for the education of my scholarship

195 recipient if I agree to this scholarship account;

196 (2) Agreeing to establish this scholarship account has the same effect as a parental

197 refusal to consent to services as described in 34 C.F.R. Sec. 300.300, issued under the

198 Individuals with Disabilities Education Act, 20 U.S.C. Sec. 1400 et seq.; and

199 (3) My child may return to a public school at any time.”.

200 (c) Upon agreeing to establish a scholarship account, the parent assumes full financial

201 responsibility for the education of the scholarship student, including the balance of any expense

202 incurred at a qualifying service provider or for goods that are not paid for by the scholarship

203 student’s scholarship account.

204 (d) Agreeing to establish a scholarship account has the same effect as a parental refusal

205 to consent to services as described in 34 C.F.R. Sec. 300.300, issued under the Individuals with

206 Disabilities Education Act, 20 U.S.C. Sec. 1400 et seq.

90 (3) (a) “Eligible service provider” means a private program or service that:

91 (i) provides educational services; and

92 (ii) meets the requirements of and is approved by a scholarship granting organization

93 under Section 53F-6-409.

94 (b) “Eligible service provider” does not include:

95 (i) an eligible school;

96 (ii) a home school; or

97 (iii) a retailer or other private business that provides goods for a one-time purchase or

98 rental.

618 Section 10. Section 53F-6-409 is enacted to read:

619 53F-6-409. Eligible service providers.

620 (1) To be an eligible service provider, a private program or service shall:

621 (a) provide to the scholarship granting organization:

622 (i) a federal employer identification number;

623 (ii) the provider’s address and contact information;

624 (iii) a description of each program or service the provider proposes to offer a

625 scholarship student and per student costs for each program or service; and

626 (iv) subject to Subsection (2), any other information as required by the scholarship

627 granting organization; and

628 (b) comply with the antidiscrimination provisions of 42 U.S.C. Sec. 2000d.

629 (2) The scholarship granting organization shall adopt policies that maximize the

630 number of eligible service providers while ensuring education programs or services provided

631 through the program meet student needs and otherwise comply with this part.

632 (3) A private program or service intending to receive scholarship funds shall submit an

633 application to the scholarship granting organization.

634 (4) The scholarship granting organization shall:

635 (a) if the private program or service meets the eligibility requirements of this section,

636 recognize the private program or service as an eligible service provider and approve a private

637 program or service’s application to receive scholarship funds on behalf of a scholarship student;

638 and

639 (b) make available to the public a list of eligible service providers approved under this

640 section.

32 Money Appropriated in this Bill:

33 This bill appropriates in fiscal year 2023:

34 ▸ to State Board of Education — Contracted Initiatives and Grants — Hope Scholarship

35 Program, as an appropriation:

36 • from Education Fund, ongoing $36,000,000; and

37 • from Education Fund, one-time ($34,000,000), leaving $2,000,000 for Fiscal

128 (13) “Scholarship granting organization” means an organization that is:

129 (a) qualified as tax exempt under Section 501(c)(3), Internal Revenue Code; and

130 (b) recognized through an agreement with the state board as a scholarship granting

131 organization, as described in Section 53F-6-404.

311 (3) The state board shall:

312 (a) conduct a financial review or audit of a scholarship granting organization, if the

313 state board receives evidence of fraudulent practice by the scholarship granting organization;

314 and

315 (b) conduct a criminal background check on each scholarship granting organization

316 employee and scholarship granting organization officer.

317 (4) (a) If the state board determines that a scholarship granting organization has

318 violated a provision of this part or state board rule, the state board shall send written notice to

319 the scholarship granting organization explaining the violation and the remedial action required

320 to correct the violation.

321 (b) A scholarship granting organization that receives a notice described in Subsection

322 (4)(a) shall, no later than 60 days after the day on which the scholarship granting organization

323 receives the notice, correct the violation and report the correction to the state board.

324 (c) (i) If a scholarship granting organization that receives a notice described in

325 Subsection (4)(a) fails to correct a violation in the time period described in Subsection (4)(b),

326 the state board may bar the scholarship granting organization from further participation in the

327 program.

340 (6) The state board shall make rules in accordance with Title 63G, Chapter 3, Utah

341 Administrative Rulemaking Act for:

342 (a) subject to Subsection (7), the administration of scholarship accounts and

343 disbursement of scholarship funds if a scholarship granting organization is barred from

344 participating in the program under Subsection (4)(c)(i); and

345 (b) audit and report requirements as described in Section 53F-7-405.

396 (3) (a) The scholarship granting organization shall:

397 (i) contract for an annual and random audits on scholarship accounts, conducted by a

398 certified public accountant who is independent from:

399 (A) the scholarship granting organization; and

400 (B) the scholarship granting organization’s accounts and records pertaining to

401 scholarship funds; and

402 (ii) in accordance with Subsection (3)(b), report the results of the audit to the state

403 board for review.

404 (b) For the report described in Subsection (3)(a)(ii), the scholarship granting

405 organization shall:

406 (i) include the scholarship granting organization’s financial statements in a format that

407 meets generally accepted accounting standards; and

408 (ii) submit the report to the state board no later than 180 days after the last day of a

409 scholarship granting organization’s fiscal year.

410 (c) The certified public accountant shall conduct an audit described in Subsection

411 (3)(a)(i) in accordance with generally accepted auditing standards.

412 (d) (i) The state board shall review a report submitted under this section and may

413 request that the scholarship granting organization revise or supplement the report if the report

414 is not in compliance with the provisions of this Subsection (3).

415 (ii) A scholarship granting organization shall provide a revised report or supplement to

416 the report no later than 45 days after the day on which the state board makes a request

417 described in Subsection (3)(d)(i).

449 Section 7. Section 53F-6-406 is enacted to read:

450 53F-6-406. Qualifying service provider regulation — Student records — Status of

451 scholarship student.

452 (1) Nothing in this part:

453 (a) grants additional authority to any state agency or LEA to regulate private schools or

454 providers except as expressly described in this part; or

455 (b) expands the regulatory authority of the state, a state office holder, or a local school

456 district to impose any additional regulation of a qualifying service provider beyond those

457 necessary to enforce the requirements of this part.

458 (2) A qualifying service provider shall be given the maximum freedom to provide for

459 the educational needs of a scholarship student who attends or engages with the qualifying

460 service provider without unlawful governmental control.

461 (3) Except as provided in Section 53F-7-403 and, respectively, Section 53F-6-408 or

462 53F-6-409, a qualifying service provider may not be required to alter the qualifying service

463 provider’s creed, practices, admission policy, or curriculum in order to accept scholarship

464 funds.

545 53F-6-408. Eligible schools.

546 (1) To be an eligible school to receive scholarship funds on behalf of a scholarship

547 student, a private school with 150 or more enrolled students shall:

548 (a) (i) contract with an independent licensed certified public accountant to conduct an

549 Agreed Upon Procedures engagement as adopted by the state board, or obtain an audit and

550 report from a licensed independent certified public accountant that conforms with the following

551 requirements:

552 (A) the audit shall be performed in accordance with generally accepted auditing

553 standards;

554 (B) the financial statements shall be presented in accordance with generally accepted

555 accounting principles; and

556 (C) the audited financial statements shall be as of a period within the last 12 months;

557 and

558 (ii) submit the audit report or report of the agreed upon procedure to the scholarship

559 granting organization when the private school applies to receive scholarship funds;

560 (b) comply with the antidiscrimination provisions of 42 U.S.C. Sec. 2000d;

561 (c) provide a written disclosure to the parent of each prospective scholarship student,

562 before the student is enrolled, of:

563 (i) the education services that will be provided to the scholarship student, including the

564 cost of those services;

565 (ii) tuition costs;

566 (iii) additional fees a parent will be required to pay during the school year; and

567 (iv) the skill or grade level of the curriculum in which the prospective scholarship

568 student will participate;

569 (d) (i) administer an annual assessment of each scholarship student’s academic

570 progress; and

571 (ii) report the results of the assessment described in Subsection (1)(d)(i) to the

572 scholarship student’s parent;

573 (e) employ or contract with teachers who:

574 (i) hold baccalaureate or higher degrees;

575 (ii) have at least three years of teaching experience in public or private schools; or

576 (iii) have the necessary skills, knowledge, or expertise that qualifies the teacher to

577 provide instruction in the subject or subjects taught;

578 (f) require the following individuals to submit to a nationwide, fingerprint-based

579 criminal background check and ongoing monitoring, in accordance with Section 53G-11-402,

580 as a condition for employment or appointment, as authorized by the Adam Walsh Child

581 Protection and Safety Act of 2006, Pub. L. No. 109-248:

582 (i) an employee who does not hold:

583 (A) a current Utah educator license issued by the state board under Title 53E, Chapter

584 6, Education Professional Licensure; or

585 (B) if the private school is not physically located in Utah, a current educator license in

586 the state where the private school is physically located;

587 (ii) a contract employee; and

588 (iii) a volunteer who is given significant unsupervised access to a student in connection

589 with the volunteer’s assignment; and

590 (g) provide to the parent of a scholarship student the relevant credentials of the teachers

591 who will be teaching the scholarship student.

619 53F-6-409. Eligible service providers.

620 (1) To be an eligible service provider, a private program or service shall:

621 (a) provide to the scholarship granting organization:

622 (i) a federal employer identification number;

623 (ii) the provider’s address and contact information;

624 (iii) a description of each program or service the provider proposes to offer a

625 scholarship student and per student costs for each program or service; and

626 (iv) subject to Subsection (2), any other information as required by the scholarship

627 granting organization; and

628 (b) comply with the antidiscrimination provisions of 42 U.S.C. Sec. 2000d.

629 (2) The scholarship granting organization shall adopt policies that maximize the

630 number of eligible service providers while ensuring education programs or services provided

631 through the program meet student needs and otherwise comply with this part.

632 (3) A private program or service intending to receive scholarship funds shall submit an

633 application to the scholarship granting organization.

634 (4) The scholarship granting organization shall:

635 (a) if the private program or service meets the eligibility requirements of this section,

636 recognize the private program or service as an eligible service provider and approve a private

637 program or service’s application to receive scholarship funds on behalf of a scholarship student;

638 and

639 (b) make available to the public a list of eligible service providers approved under this

640 section.

641 (5) A private program or service approved under this section that changes ownership

642 shall:

643 (a) submit a new application to the scholarship granting organization; and

644 (b) demonstrate that the private program or service continues to meet the eligibility

645 requirements of this section.

Some final thoughts to chew over:

First

This analysis focused mainly on how the USBE, through this bill, would gain unprecedented access to the private educations of students should they accept public monies to fund those educations in any way.

And as these are public education monies administered by the state board which accepts Federal education funding, the state board itself is still subject to complying with Federal regulation in every program it oversees.

Any private school or person who accepts these scholarship funds cannot reasonably expect to be exempt from future compliance measures or rules imposed by either state law or Federal fiat. To expect otherwise would demonstrate a naivete as to how government operates when its powers are expanded.

Second

The potential negative impact upon religious private schools can’t be overstated. Parochial schools that don’t want to risk losing control over their curriculum, compromising their unique focus, or even just dealing with extra red tape will have to turn away HOPE Scholarship students. They’ll lose their ability to compete with institutions eager to accept government funding, strings and all, and will see enrollment levels inevitably decline should they refuse to conform.

If you need any more convincing, this account of religious schools in Pennsylvania gives you a good idea of what happens when government injects money into private markets. The balance of those markets gets thrown off as dependency on and demand for government subsidies rise. Paradoxically, fewer, not more, substantive educational choices are created. Oh, you may see more schools created as a result, but there will be an inevitable cookie-cutter quality about them due to the pressure to comply with a top-down, government-dictated vision, resulting in fewer actual choices in the long run. It’s like asking your kids, “Do you want to eat at McDonalds in Midvale or in Holladay?”

Third

No matter how well meaning the Hope Scholarship proponents are, the fact remains that this is a wealth-redistribution effort. Those who benefit the most are those who pay the least, if anything, in public education taxes. While per-pupil spending in low-income areas is already at all-time highs, ranging from $12-18K per student, this scholarship program at its most generous will only distribute around $8k per student, subject to change every year based on a multitude of factors. Simply put, the math doesn’t add up, in more ways than one.

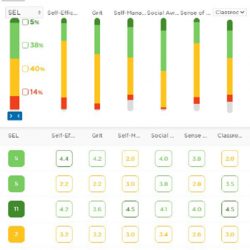

Public education in Utah has serious problems. Radical racial and sexual ideologies and materials have seeped into every aspect of K-12 schools, our children are being assessed and surveyed for their beliefs, attitudes, and values, parents and teachers who speak up about this toxicity are silenced, and the adults in charge are fiddling while Rome burns around them. School choice scholarships that don’t really increase school “choice” and aren’t really “scholarships” only offer false hope to parents desperate for solutions.

Faustian bargains look fantastic, until we realize that what we’ve given up can’t ever be reclaimed.